一个量化交易系统的诞生记

量化之路酝酿良久,终于迈步。

导言

这个项目的主要目的是

- 熟悉搭建量化交易系统的主要流程;

- 验证一个简单的套利策略的可行性。

交易的标的是BTC现货和合约。

架构设计

1 | graph LR |

模块搭建

数据模块

- 数据源:

- Binance API

- 第三方库:ccxt

- 实现功能:

- 下载数据;

- 缓存数据。

- 代码

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

146

147

148import ccxt

import pandas as pd

import pickle

import time

import logging

from tqdm import tqdm

from datetime import datetime, timezone

ENABLE_DEBUG = True

logging.basicConfig(level=logging.INFO,

format='%(asctime)s - %(levelname)s - %(message)s')

class DataFetcher:

def __init__(self, exchange_name='binance'):

# 初始化时不再强制使用默认交易所逻辑,fetch_data中会根据参数创建交易所实例

self.default_exchange_name = exchange_name

self.proxy_url = 'http://127.0.0.1:7890'

self.timezone = 'Asia/Shanghai'

def fetch_data(self, symbol='BTC/USDT',start_time = "2024-01-01 00:00:00", range = '30d', timeframe='5m', contract_type='spot', data_source='binance'):

"""获取指定数据来源的现货或合约数据"""

# 根据CONFIG计算时间范围

start_time_ms = int(datetime.strptime(start_time,

# 起始时间戳

"%Y-%m-%d %H:%M:%S").timestamp())*1000

range_ms = self._parse_range(range)

end_time = start_time_ms + range_ms

file_year = datetime.fromtimestamp(

start_time_ms/1000, tz=timezone.utc).strftime('%Y-%m-%d-%H:%M:%S')

file_base = f'{data_source}_{contract_type}_{symbol.replace("/", "")}_{timeframe}_{file_year}_{range}'

cache_pkl = f'database/{file_base}.pkl'

cache_csv = f'database/{file_base}.csv'

# 尝试加载缓存数据

try:

with open(cache_pkl, 'rb') as f:

all_ohlcv = pickle.load(f)

df = self._process_data(all_ohlcv)

logging.info("加载缓存数据成功")

return df

except FileNotFoundError:

logging.info("未找到缓存数据,开始从交易所获取数据...")

# 根据 data_source 创建交易所实例

exchange = getattr(ccxt, data_source)({

'enableRateLimit': True,

'options': {'adjustForTimeDifference': True},

'proxies': {'http': self.proxy_url, 'https': self.proxy_url},

'timeout': 30000

})

# 设置市场类型

exchange.options['defaultType'] = contract_type

if contract_type == 'future':

exchange.options['defaultSettle'] = 'usdt'

all_ohlcv = []

since = start_time_ms

total_range = end_time - start_time_ms

progress_bar = tqdm(total=total_range, desc="下载进度", unit="ms")

while since < end_time:

batch_limit = 1000

try:

batch = exchange.fetch_ohlcv(

symbol=symbol,

timeframe=timeframe,

since=since,

limit=batch_limit

)

if not batch:

logging.info("无更多数据可获取,退出循环")

break

all_ohlcv.extend(batch)

new_since = batch[-1][0] + \

self._timeframe_to_ms(timeframe)

if new_since <= since:

logging.warning("时间戳未更新,退出循环以避免无限循环")

break

update_amount = min(new_since, end_time) - since

progress_bar.update(update_amount)

since = new_since

time.sleep(exchange.rateLimit / 1000)

except ccxt.RequestTimeout as e:

logging.error(f"请求超时: {e}")

time.sleep(30)

continue

except ccxt.ExchangeError as e:

logging.error(f"交易所错误: {e}")

break

except Exception as e:

logging.exception("未知错误:")

break

progress_bar.close()

# 保存下载数据到缓存,并在文件名中包含数据来源信息

try:

with open(cache_pkl, 'wb') as f:

pickle.dump(all_ohlcv, f)

df = self._process_data(all_ohlcv)

with open(cache_csv, 'w') as f:

f.write(df.to_csv())

logging.info(f"数据保存成功,保存文件: {cache_csv}")

except Exception as e:

logging.error(f"缓存数据保存失败: {e}")

return df

def _process_data(self, data):

df = pd.DataFrame(

data, columns=['timestamp', 'open', 'high', 'low', 'close', 'volume'])

df['timestamp'] = pd.to_datetime(df['timestamp'], unit='ms')

df.set_index('timestamp', inplace=True)

return df

def _timeframe_to_ms(self, timeframe):

"""将 timeframe 字符串转换为毫秒值,仅支持 '5m',可扩展支持更多"""

if timeframe == '5m':

return 5 * 60 * 1000

else:

raise ValueError(f"不支持的时间周期: {timeframe}")

def _parse_range(self, range_str):

"""将 range 字符串转换为毫秒值,支持格式 '1d'、'1M'、'1y'"""

unit = range_str[-1]

try:

num = int(range_str[:-1])

except ValueError:

raise ValueError(f"range 格式错误: {range_str}")

if unit.lower() == 'd':

return num * 24 * 60 * 60 * 1000

elif unit.lower() == 'm':

return num * 30 * 24 * 60 * 60 * 1000 # 近似1个月按30天计算

elif unit.lower() == 'y':

return num * 365 * 24 * 60 * 60 * 1000 # 按365天计算

else:

raise ValueError(f"不支持的 range 单位: {unit}")

if __name__ == '__main__':

fetcher = DataFetcher()

logging.info('正在获取数据...')

spot = fetcher.fetch_data(symbol='ETH/USDT', start_time='2025-01-01 00:00:00', range='30d', timeframe='5m', data_source='binance')

logging.info('数据获取完成')

logging.info(f'数据量: {len(spot)}')

logging.info('数据预览:')

logging.info(spot.head())

策略模块

这里选择的策略是一个简单的统计套利(Pairs Trading)。标的是BTC现货和U本位永续合约。基本逻辑:假设价差满足均值回归,在价差扩大时做空价差、在价差缩小时做多价差。

这里偷个懒,直接把信号放进市场数据那个dataframe里,后续可以再模块化,这样程序逻辑会更清晰。1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106import pandas as pd

import numpy as np

from datafetcher import DataFetcher

from datetime import datetime

ENABLE_DEBUG = True

class MeanReversionStrategy:

"""均值回归策略"""

def __init__(self):

self.SYMBOL = 'BTC/USDT'

self.TIMEFRAME = '15m'

self.RANGE = '180d'

self.START_TIME = '2024-01-01 00:00:00'

self.zscore_window = 12 # 窗口

self.zscore_threshold = 1.8 # 阈值

SPOT_FUTURE_PORTION = 0.5 # 现货和合约仓位比例

def load_data(self):

"""导入数据"""

fetcher = DataFetcher()

spot = fetcher.fetch_data(symbol=self.SYMBOL, start_time=self.START_TIME, range=self.RANGE, timeframe=self.TIMEFRAME, contract_type='spot')[['close']].rename(

columns={'close': 'spot'})

future = fetcher.fetch_data(symbol=self.SYMBOL, start_time=self.START_TIME, range=self.RANGE, timeframe=self.TIMEFRAME, contract_type='future')[['close']].rename(

columns={'close': 'future'})

# 合并数据

self.market_data = pd.merge(spot, future, left_index=True,

right_index=True, how='inner')

# 调试

if ENABLE_DEBUG:

spot.to_csv('debug/spot.csv')

future.to_csv('debug/future.csv')

def generate_signals(self):

"""生成交易信号"""

zscore_window = self.zscore_window

zscore_threshold = self.zscore_threshold

# 计算溢价

self.market_data['premium'] = self.market_data['spot'] - self.market_data['future']

# 计算溢价率

self.market_data['premium_pct'] = (

# (现货价格 - 合约价格) / 现货价格

self.market_data['spot'] - self.market_data['future']) / self.market_data['spot'] * 100

# 计算统计指标

self.market_data['mean_premium_pct'] = self.market_data['premium_pct'].rolling(

zscore_window).mean()

self.market_data['std'] = self.market_data['premium_pct'].rolling(

zscore_window).std()

self.market_data['zscore'] = (self.market_data['premium_pct'] -

self.market_data['mean_premium_pct']) / self.market_data['std']

# 生成原始信号

self.market_data['raw_signal'] = 0

self.market_data.loc[self.market_data['zscore'] > zscore_threshold,

'raw_signal'] = -1 # 溢价率高于阈值,做空溢价, 同时做空现货、做多合约

self.market_data.loc[self.market_data['zscore'] < -zscore_threshold,

'raw_signal'] = 1 # 溢价率低于阈值,做多溢价, 同时做多现货、做空合约

self.market_data['signal'] = self.market_data['raw_signal']

# 计算 20 SMA

self.market_data['SMA'] = self.market_data['premium_pct'].rolling(

window=2*zscore_window).mean()

# 过滤低波动时段

self.market_data.loc[self.market_data['volatility'] <

0.01, 'signal'] = 0

# 调试

if ENABLE_DEBUG:

self.market_data[['signal']].to_csv('debug/signals.csv')

return self.market_data

if __name__ == '__main__':

engine = MeanReversionStrategy()

engine.load_data()

engine.generate_signals()

from visualizer import Visualizer

visualizer = Visualizer()

visualizer.link_strategy(engine)

visualizer.load_data(engine.market_data)

visualizer.plot_signals(engine.market_data)

# from backtest import run_backtest

# trade_history, metrics = run_backtest(engine.market_data) # 调用回测模块

# print(f'[{datetime.now()}] 回测完成。')

# if not trade_history.empty:

# print(f'[{datetime.now()}] 交易记录:')

# print(trade_history.head())

# if ENABLE_DEBUG:

# trade_history.to_csv('debug/trade_history.csv')

# if metrics:

# print(f'[{datetime.now()}] 交易指标:')

# for k, v in metrics.items():

# print(f'{k}: {v}')

回测模块

有很多现成的回测框架,如backtrader之类。这里自己写一个run_backtest函数。

实现功能:

- 根据信号进行交易;

- 做多信号:做多现货,做空合约;

- 做空信号:做空现货,做多合约;

- 仓位管理,可以根据价差的zscore调整杠杆率;

- 记录仓位;

- 计算输出指标:

- PnL

- 最大回撤

- 修复时间

- 夏普比率

1 | import pandas as pd |

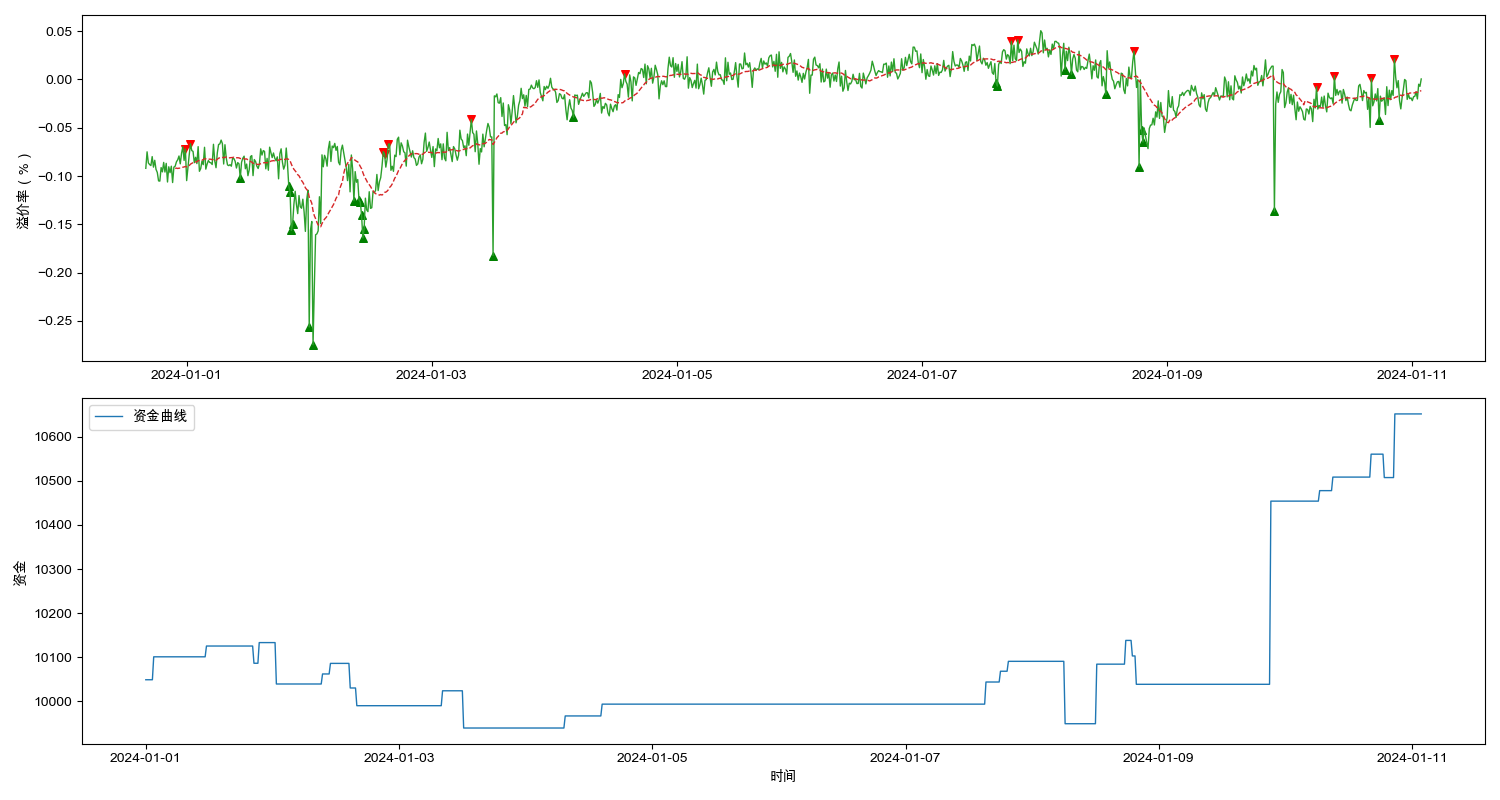

回测结果:1

2

3

4

5

6

7

8

9

10初始资金: 10000

最终资金: 10651.176791099295

总收益: 651.1767910992949

年化收益率: 815.442016678132 %

胜率: 67.85714285714286 %

交易次数: 28

平均持仓时间: 0.7589285714285714 h

最大回撤: -1.9089572651408093 %

最大回撤修复时间: 125.5 h

夏普比率: 23.28055581414463

可视化模块

使用matplotlib。模块化绘图函数。加入绘图函数注册机制,方便以后拓展。

1 | import pandas as pd |

可视化结果:

进阶方向

不一而足,方向很多:

- 多因子模型开发;

- 结合期权定价与波动率交易;

- 基于强化学习的超参数优化。